FLORIDA WILDLIFE CORRIDOR EASES WORST IMPACTS OF CLIMATE CHANGE

From rising temperatures and altered precipitation patterns to intense weather events such as hurricanes, Florida is experiencing significant climate-related challenges in tandem with skyrocketing insurance rates.... more

FAU LANDS $1.3 MILLION GRANT TO CLEAN UP STINKY SEAWEED IN FLORIDA

In the last decade, the emergence of a massive expanse of Sargassum, the Great Atlantic Sargassum Belt, has wreaked havoc on ecosystems and economies throughout the Caribbean. Conversely, this stinky brown seaweed provides vital habitats for marine life including loggerhead sea turtles.... more

‘Back to the Future’ to Forecast the Fate of a Dead Florida Coral Reef

Going back thousands of years to reconstruct a coral death assemblage, a study offers a glimpse into a once vibrant coral reef community and explores if history can repeat itself in the face of climate change.... more

NEWS DESK

FAU Researcher Earns Top Award for Marine Natural Products

Amy Wright, Ph.D., research professor at FAU Harbor Branch Oceanographic Institute, received the Paul J. Scheuer Award in Marine Natural Products, considered the foremost accolade in the field.

Hispanic Consumer Index Finds More Optimism About Finances, Economy

Hispanics were more optimistic about their finances and the economy due to the declining unemployment rate among Hispanics, a new poll from FAU BEPI shows.

FAU/Mainstreet Research Florida Poll Shows Trump Holds Lead Over Biden

Former U.S. President Donald Trump continues to maintain a formidable lead over U.S. President Joe Biden among Florida voters

- TAGS:

FAU Engineering Selected by NASA for University Nanosatellite Program

The College of Engineering and Computer Science is among eight university teams in the U.S. selected to work with NASA and the U.S. military to foster innovation and expertise in the small satellite sector.

FAU Receives Gift to Create Craig and Barbara Weiner Holocaust Museum

Florida Atlantic University has received a significant gift to establish the Craig and Barbara Weiner Holocaust Museum of South Florida at FAU.

Aspiring Entrepreneurs Win Big at FAU's Business Pitch Competition

A device that uncovers health conditions and a sustainable bracelet company were among the winners at Florida Atlantic University's 16th annual Business Pitch Competition.

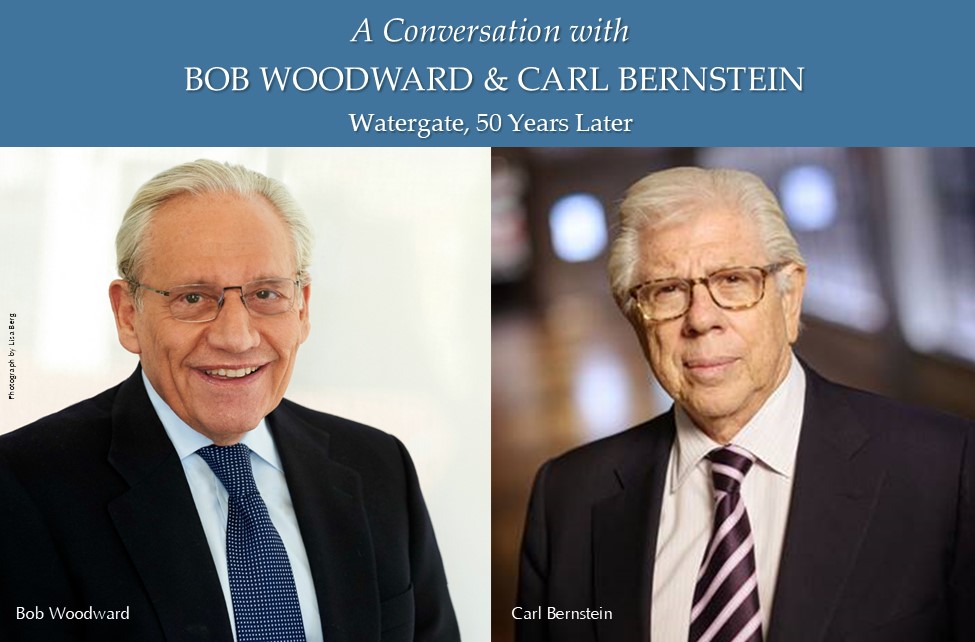

OLLI at FAU Presents Bob Woodward and Carl Bernstein

Osher Lifelong Learning Institute (OLLI) at Florida Atlantic University presents Bob Woodward and Carl Bernstein.

- TAGS:

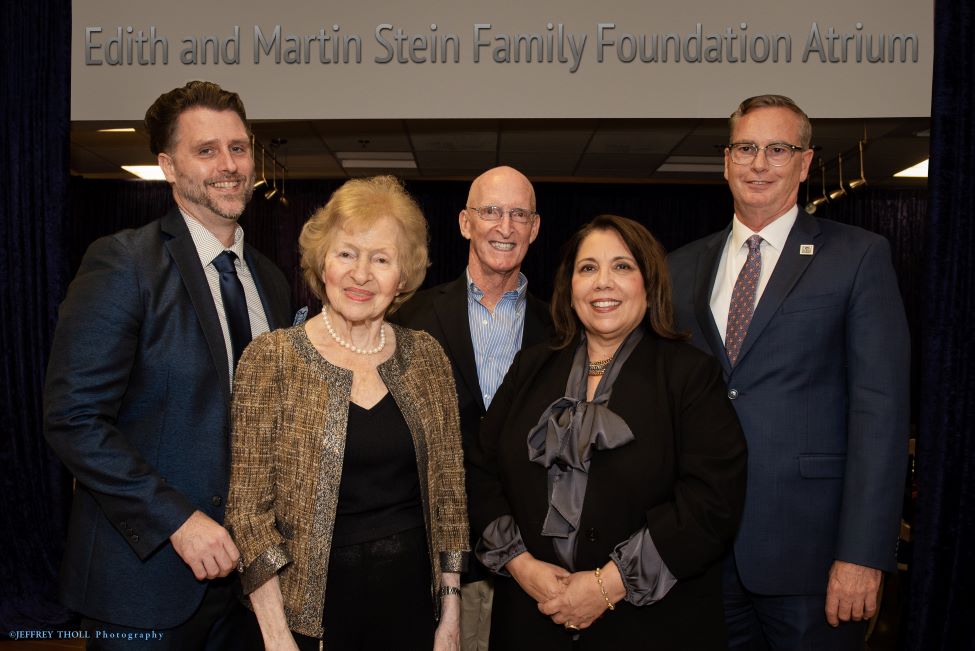

FAU Receives Gift to Support Theater Performances and Arts Education

FAU's Dorothy F. Schmidt College of Arts and Letters has received a significant gift from the Edith and Martin Stein Family Foundation to support performances and arts education at the university's Theatre Lab.

A Chorus Line, Big Band Concerts and More

FAU has announced the lineup for this summer's Festival Rep.

- TAGS:

FAU President's Gala Benefits Scholarships and Student Success

Florida Atlantic University has raised more than $1.2 million in support of scholarships and student success at its recent 2024 President's Gala

Noble Capital Markets Brings the 'Sharks' to FAU for NobleCon20

Noble Capital Markets and Florida Atlantic University's College of Business will host NobleCon20, the 20th annual emerging growth equity conference at the College's Executive Education Complex.

FAU Receives Record-breaking Number of Applications

Florida Atlantic University has received more than 46,000 first-year applications for fall - an all-time university record.

- TAGS:

Fear the Tails, Not the Jaws, of These ‘Weirdo’ Sharks

Scientists studied how thresher sharks use “extreme yoga” to whip their tails at prey.... more